Thursday, July 4, 2024 06:32 PM

Pakistan's Power Subsidies Surge, IMF's Approval Questioned

- Record increase in power subsidies sparks concerns on sustainability

- IMF's approval of subsidy rise contradicts Circular Debt Management Plan

- Transparency and clarity crucial for balancing fiscal responsibility in energy sector

Image Credits: brecorder

Image Credits: brecorderThe recent surge in power subsidies in Pakistan's budget raises concerns about sustainability and transparency, with questions arising over the IMF's approval and the government's fiscal responsibility in managing circular debt accumulation.

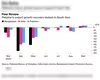

Energy subsidy reforms in Pakistan have been a hot topic lately, with discussions revolving around limiting subsidies to the most vulnerable groups and eventually phasing them out. However, the recent budget announcement has surprised many as it reveals a significant increase in subsidies for the power sector, reaching a record Rs1.19 trillion. This allocation is double the amount from the previous fiscal year, sparking concerns about the effectiveness of the ongoing reforms.

The finance minister has stressed the importance of eliminating circular debt accumulation and has laid out strategies to bolster the distribution and transmission sectors while also promoting renewable energy sources. Despite these efforts, the budget documentation indicates a noticeable surge in inter-discos tariff differential subsidies, hinting at a continued reliance on subsidies rather than sustainable long-term solutions.

The substantial rise in power subsidies, including allocations for regions like AJK, has raised doubts about the government's dedication to fiscal responsibility. The lack of transparency surrounding the utilization of these funds and the absence of a clear plan to tackle circular debt accumulation further complicate the situation.

Interestingly, the IMF has approved the upward revision in power subsidies, which seems contradictory to its emphasis on implementing the Circular Debt Management Plan. The reported halt in circular debt accumulation by the government since October 2023 has also cast doubts on the effectiveness of the current strategy, especially given the significant budgetary allocation for subsidies.

Looking ahead, as the government gears up for a base tariff revision in July 2024, it will be crucial to provide clarity on the extent of subsidies needed for unprotected segments. The necessity for cash settlements to reduce the circular debt stock, aligning with the IMF's recommendations, remains a contentious issue amidst the substantial subsidy allocations in the budget.

The surge in power subsidies in Pakistan's recent budget has raised concerns about the sustainability of the current approach. With conflicting signals from the IMF and a lack of clarity on the utilization of funds, the government faces a challenging task in balancing fiscal responsibility with the need to support the energy sector. As stakeholders await the base tariff revision in July 2024, transparency and a clear roadmap for addressing circular debt accumulation will be key to ensuring a stable and efficient power sector for the country's future.