Thursday, July 4, 2024 06:19 PM

U.S. Equities Surge, Global Stocks Rebound

- Nasdaq Composite and S&P 500 hit record highs driven by tech and consumer sectors

- Market analysts optimistic about stock momentum, but concerns of potential pullback linger

- Global stocks rebound after two sessions of declines, U.S. Treasury yields rise

Image Credits: channelnewsasia

Image Credits: channelnewsasiaGlobal stocks rebound as U.S. equities surge to record highs, driven by tech and consumer sectors. Market analysts optimistic about stock momentum, but concerns of potential pullback linger. Central banks and economic data influence market dynamics.

Global stocks saw a positive turnaround on Monday, with U.S. equities leading the way alongside a rise in U.S. Treasury yields. The Nasdaq Composite and S&P 500 achieved record highs, primarily driven by gains in the technology and consumer discretionary sectors. Economic data for June indicated an improvement in manufacturing activity in the New York region, setting a positive tone for investors. The upcoming retail sales data for May is eagerly anticipated as a key indicator of consumer health.

Market analysts are optimistic about the current momentum in stocks, expecting the upward trend to persist. However, concerns linger regarding a potential deeper pullback, particularly due to the reliance on a limited number of stocks for the market rally.

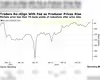

The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experienced gains, with Goldman Sachs and Evercore ISI raising their year-end price targets for the S&P 500. Last week, U.S. equities reached unprecedented levels amidst reduced inflation pressures and updated economic forecasts from the Federal Reserve.

In Europe, stocks made modest gains following political uncertainties in France that led to losses in the previous week. The global stock gauge rebounded after two consecutive sessions of declines, while U.S. Treasury yields also rose, with the 10-year note recovering from its largest weekly drop this year.

Investors are closely watching for statements from Federal Reserve officials, anticipating a potential rate cut in September. Central banks in Australia, Norway, and Britain are expected to maintain their interest rates, while the Swiss National Bank might consider easing due to the strength of the Swiss franc.

The dollar index declined, resulting in the euro and yen strengthening against the greenback. Crude oil prices saw an increase as investor confidence in future demand growth grew. Overall, the market sentiment remains positive, with a keen focus on upcoming economic data releases and central bank decisions.

The recent rebound in global stocks, driven by U.S. equities and Treasury yields, reflects a renewed sense of optimism among investors. While concerns about a potential market correction persist, the overall outlook remains positive. With key economic indicators and central bank policies shaping market dynamics, investors are navigating through a landscape of opportunities and risks, poised for further developments in the financial landscape.