Thursday, July 4, 2024 07:18 PM

Individuals urged to claim refunds for withholding tax

- 85% of tax burden falls on individuals, especially lower incomes

- Taxpayers can request refund for withholding tax when filing returns

- Understanding indirect taxes like withholding tax is crucial for taxpayers

Image Credits: tribune.com.pk

Image Credits: tribune.com.pkLearn about the impact of withholding tax on individuals, how to claim refunds, and the importance of understanding indirect taxes for effective tax management.

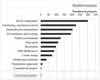

Indirect taxes, such as the withholding tax (WHT), make up a significant portion of the taxes paid by individuals. Recent reports have shown that 85% of the tax burden falls on individuals, especially those with lower incomes. This means that individuals with lower incomes are disproportionately affected by these taxes compared to those with higher incomes.

One key finding that has come to light is that taxpayers are not always required to pay the WHT. It has been discovered that individuals can request a refund for the WHT when they file their annual tax returns. This information can be crucial for individuals looking to reduce their tax burden and maximize their refunds.

Understanding the intricacies of indirect taxes, such as the withholding tax, is essential for all taxpayers. By being aware of their rights and options, individuals can make informed decisions when it comes to managing their taxes. Remember, it's important to stay informed and seek professional advice if needed to ensure you are taking full advantage of all available tax benefits.