Thursday, July 4, 2024 07:40 PM

President Zardari lauds Banking Mohtasib for resolving customer complaints

- BMP processed 25,000 complaints, providing Rs. 1.26 billion relief in 2023

- Total relief offered by BMP to complainants is Rs. 6.4 billion

- Introduction of user-friendly online portal streamlined complaint registration process

Image Credits: 92 News

Image Credits: 92 NewsPresident Zardari praises Banking Mohtasib Pakistan for efficiently resolving over 25,000 complaints and providing Rs. 1.26 billion relief to customers in 2023. The introduction of a user-friendly online portal has enhanced the complaint registration process, showcasing BMP's commitment to prompt grievance resolution and upholding transparency in the financial sector.

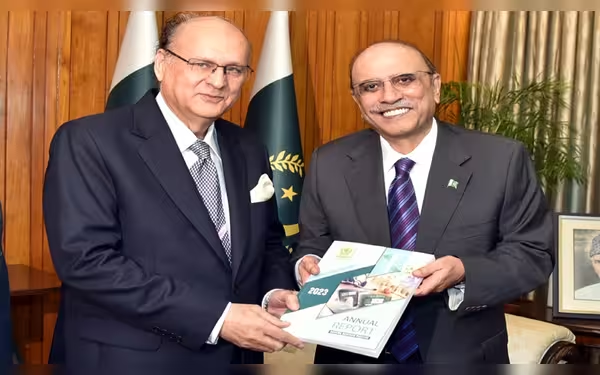

President Asif Ali Zardari commended the Banking Mohtasib Pakistan (BMP) for its outstanding performance in processing over 25,000 complaints and providing monetary relief amounting to Rs. 1.26 billion to banking customers in 2023. The president praised BMP during a meeting with Sirajuddin Aziz, the banking ombudsman, who presented the Annual Report of BMP at Aiwan-e-Sadr.

Since its establishment, the Banking Mohtasib has offered a total relief of Rs. 6.4 billion to complainants, showcasing its commitment to resolving grievances promptly. The introduction of a user-friendly online portal has further streamlined the complaint registration process, ensuring easier access for individuals seeking redressal.

President Zardari emphasized the crucial role of the banking Mohtasib in providing free-of-cost justice to victims of fraud and promoting good governance. He stressed the importance of leveraging technological advancements to enhance the efficiency of complaint resolution and urged for increased awareness about the services offered by BMP to combat maladministration in banks.

In conclusion, the efforts of the Banking Mohtasib Pakistan in swiftly addressing customer complaints and delivering financial relief underscore its significance in safeguarding the interests of banking consumers and upholding transparency in the financial sector.