Sunday, July 7, 2024 12:42 PM

Iran's Supreme Leader praises armed forces for missile attack

- Iran launches first direct attack on Israel with over 300 missiles and drones

- Chicago Federal Reserve President expresses concerns about stalled progress in curbing inflation

- Saudi Arabia's benchmark index sees slight increase supported by rise in ACWA Power

Image Credits: VOA News

Image Credits: VOA NewsThe Gulf stock markets react to geopolitical tensions, Iran's missile attack on Israel, US Federal Reserve concerns, and regional economic challenges.

The stock markets in the Gulf region remained subdued on Sunday due to ongoing geopolitical tensions and uncertainties surrounding US Federal Reserve policy. Iran launched its first direct attack on Israel by sending over 300 missiles and drones in retaliation for an alleged deadly strike on its embassy compound in Damascus. Iran's Supreme Leader praised the armed forces for the attack, emphasizing the country's military strength.

Chicago Federal Reserve President highlighted concerns about inflation, stating that progress in curbing inflation has stalled this year. This shift in focus from potential interest rate cuts reflects a broader trend among US central bankers.

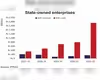

In individual market movements, Saudi Arabia's benchmark index saw a slight increase, supported by a rise in ACWA Power. However, the International Monetary Fund revised down its growth forecast for the Middle East and North Africa region, citing various challenges including the conflict in Gaza and lower oil output.

Qatar's benchmark index declined, impacted by losses in Industries Qatar and Qatar Islamic Bank. On the other hand, Egypt's blue-chip index rebounded after previous losses, driven by gains in Commercial International Bank. The Central Bank of Egypt reported a decrease in its net foreign assets deficit, attributed to property development sales and currency reforms.