Sunday, December 22, 2024 03:21 AM

Pakistani Rupee Marginally Depreciates Against US Dollar

- Rupee closes at 278.04, down 0.03%.

- US dollar index falls nearly 0.8%.

- Oil prices remain stable amid market fluctuations.

Image Credits: brecorder

Image Credits: brecorderThe Pakistani rupee has slightly depreciated against the US dollar, closing at 278.04 in the inter-bank market.

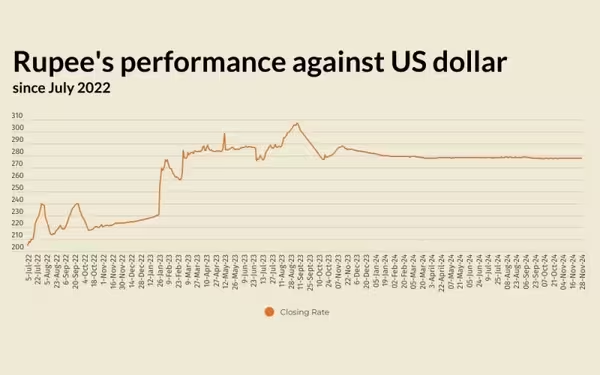

The Pakistani rupee has experienced a slight dip against the US dollar, marking a depreciation of 0.03% in the inter-bank market on Thursday. This decline means that the rupee closed at 278.04, which is a loss of Re0.08 compared to the previous day when it settled at 277.96, as reported by the State Bank of Pakistan (SBP).

In the global market, the euro has seen its most significant rise in four months, driven by hawkish comments from a central bank policymaker. Meanwhile, the Japanese yen is on track for its strongest week in three months, fueled by increasing expectations that Japan may raise interest rates in December. These developments have contributed to a slowdown in the dollar's recovery, especially with the US Thanksgiving holiday approaching, which is expected to result in thinner trading volumes.

Traders have noted a decrease in corporate dollar buying as companies have met their month-end requirements, leading to a broader decline in the dollar's value. The US dollar index fell by nearly 0.8% overnight, settling at 106.13. Additionally, overnight US yields decreased, further exerting downward pressure on the dollar. This was in response to data indicating that US personal consumption expenditure rose by 0.2% month-on-month, aligning with market expectations.

Oil prices, which are crucial for currency valuation, remained stable on Thursday. This stability followed an unexpected increase in US gasoline inventories and the postponement of the OPEC+ meeting on output policy from December 1 to December 5. Brent crude futures saw a slight increase of 8 cents, reaching $72.91 a barrel, while US West Texas Intermediate crude futures rose by 7 cents to $68.79.

In the open market, the Pakistani rupee lost 28 paise for buying and 9 paise for selling against the US dollar, closing at 277.43 and 279.06, respectively. Against the euro, the rupee depreciated by 1.37 rupees for buying and 1.38 rupees for selling, closing at 291.14 and 293.89, respectively. However, the rupee gained 2 paise for buying against the UAE Dirham, remaining unchanged for selling, closing at 75.25 and 75.97, respectively. Similarly, against the Saudi Riyal, the rupee gained 2 paise for buying and remained stable for selling, closing at 73.50 and 74.18, respectively.

The fluctuations in the currency market reflect a complex interplay of local and international economic factors. As the US Thanksgiving holiday approaches, traders and investors will be closely monitoring these developments, as they could have significant implications for the Pakistani economy. Understanding these trends is essential for anyone looking to navigate the financial landscape effectively.