Sunday, December 22, 2024 02:48 AM

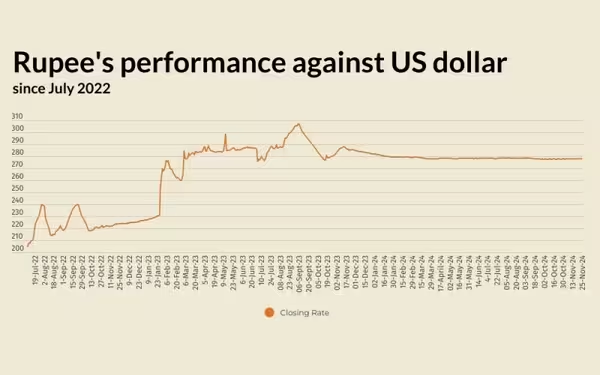

Pakistani Rupee Shows Stability Against US Dollar

- Rupee settles at 277.75, gaining Re0.01.

- US dollar retreats from recent highs.

- Oil prices decline amid supply concerns.

Image Credits: brecorder

Image Credits: brecorderThe Pakistani rupee remains stable against the US dollar, closing at 277.75 amid global economic shifts and oil price fluctuations.

The Pakistani rupee has shown a remarkable level of stability against the US dollar in the inter-bank market, particularly on Monday. As the trading day concluded, the rupee settled at 277.75, marking a slight gain of Re0.01 against the greenback. This comes after a week where the rupee experienced a minor decline, depreciating by Re0.09 or 0.03% against the US dollar. The previous week, the local currency closed at 277.76, compared to 277.67 from the week before, as reported by the State Bank of Pakistan (SBP).

On a global scale, the US dollar has slightly retreated from its recent highs. This shift was influenced by the nomination of Scott Bessent as the US Treasury Secretary, which seemed to calm the bond market and lower yields. The yields on 10-year Treasuries fell to 4.351%, down from 4.412% late Friday. Bessent, known for his fiscal conservatism and experience on Wall Street, has also advocated for a strong dollar and supported tariffs, indicating that any decline in the dollar's value may be temporary.

Interestingly, the US dollar has been on a winning streak, rising for eight consecutive weeks, a feat achieved only three times this century. Many technical indicators now suggest that the dollar may be overbought, leading to a potential consolidation phase. The dollar index was last seen down 0.5% at 106.950, having reached a two-year peak of 108.090 on Friday. Additionally, the dollar dipped 0.4% against the Japanese yen, trading at 154.11.

Market analysts are also anticipating more aggressive easing measures from the European Central Bank (ECB), with the likelihood of a half-point rate cut in December rising to 59%. In contrast, the Federal Reserve's chance of a quarter-point rate cut has decreased to 52%, down from 72% a month ago. This divergence in monetary policy expectations has led to a significant difference in easing projections, with the ECB expected to implement 154 basis points of easing by the end of next year, compared to just 65 basis points from the Fed.

Oil prices, which are crucial for currency parity, experienced a slight decline on Monday after a substantial 6% increase the previous week. However, ongoing supply concerns due to rising tensions between Western nations and major oil producers like Russia and Iran have kept prices relatively stable. Brent crude futures fell by 43 cents, or 0.57%, to $74.74 a barrel, while US West Texas Intermediate crude futures dropped 51 cents, or 0.73%, to $70.73 a barrel.

In the open market, the Pakistani rupee gained 1 paisa for buying but lost 2 paise for selling against the US dollar, closing at 276.97 for buying and 278.79 for selling. Against the Euro, the rupee lost 1.98 rupees for buying and 1.99 rupees for selling, closing at 288.85 and 291.61, respectively. The rupee remained unchanged against the UAE Dirham for buying but gained 3 paise for selling, closing at 75.26 and 75.97, respectively. Similarly, against the Saudi Riyal, the rupee remained stable for buying and gained 2 paise for selling, closing at 73.52 and 74.18, respectively.

The stability of the Pakistani rupee against the US dollar reflects a complex interplay of local and global economic factors. As the markets continue to react to international developments, it is crucial for stakeholders to remain vigilant and informed. Understanding these dynamics can help individuals and businesses make better financial decisions in an ever-changing economic landscape.